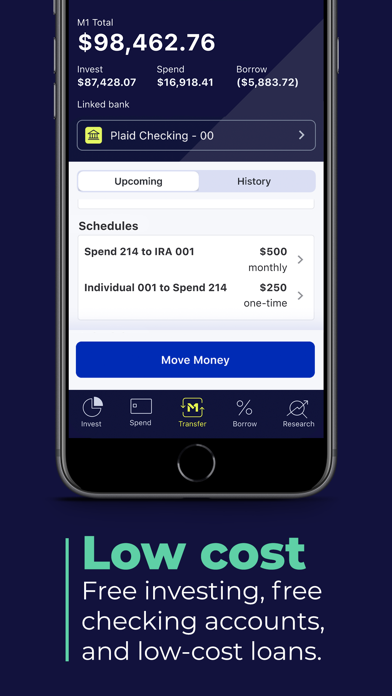

NEW: SMART TRANSFERS

Goodbye manual calculations. Now, you can build a system of automated rules that lets you organize your transactions with just a few clicks. Your money will move between your M1 accounts automatically, so you can optimize your investing, borrowing, and spending.

—

YOURS TO BUILD

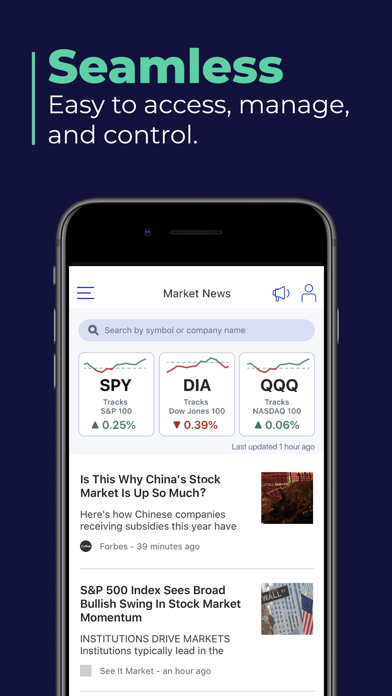

With our next-generation, intelligent financial tools, you can do exactly what you want with your investing, borrowing, and spending. The cherry on top? It’s free.

Join more than 500,000 investors who’ve opened up accounts to automate their finances with M1.

INVEST SMARTER

You’re in the driver’s seat. Create your portfolio with any stock and/or ETF, for free, and use our intelligent automation tools to invest on a schedule, rebalance with one click, and more.

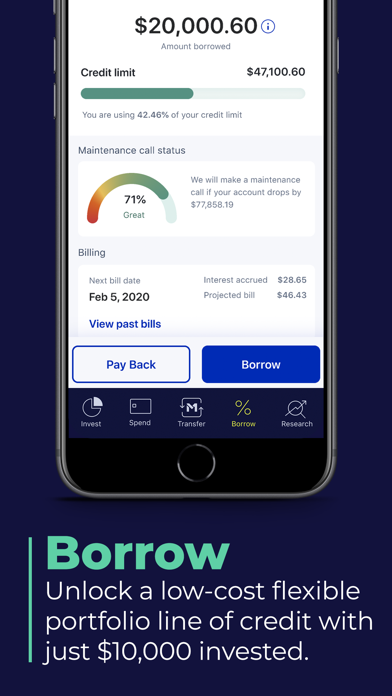

BORROW FOR LESS

Borrow money at just 2-3.5% and use it for whatever you want: more buying power, emergencies, large purchases, you choose. Unlock this flexible portfolio line of credit with just $10,000 invested.

SPEND

Access your money instantly and move money between investments seamlessly with your M1 checking account.

ENJOY M1 FOR FREE, OR UPGRADE TO M1 PLUS FOR MORE PERKS

– 1% APY* checking (that’s 25x the national average APY for a checking account)

– 1% cash back on M1 Plus Visa™ debit card purchases

– 1.50% reduction on M1 Borrow base rate**

– Unlock a second daily trading window for more control over your investments

– NEW: Get access to Smart Transfers

ACCOUNT PROTECTION

– Securities in M1 Invest accounts are insured up to $500,000 by the SIPC.

———-

– M1 Spend checking accounts may be insured up to $250,000 by the FDIC.

———-

– We are a technology-first company that utilizes the latest in information security.

DISCLAIMERS

**Borrow rates may vary. Borrow not available for retirement accounts.

All investing involves risk, including the risk of losing the money you invest, and past performance does not guarantee future performance. Borrowing on margin can add to these risks, and you should learn more before borrowing. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors.

M1 Plus is an annual membership that confers benefits for products and services offered by M1 Finance LLC and M1 Spend LLC, each a separate, affiliated, and wholly-owned operating subsidiary of M1 Holdings Inc. “M1” refers to M1 Holdings Inc., and its affiliates.

Brokerage products and services offered by M1 Finance LLC, an SEC registered broker-dealer and Member FINRA / SIPC.

—-

*No minimum balance to open account. No minimum balance to obtain APY (annual percentage yield). APY valid from account opening. Fees may reduce earnings. Rates may vary.

M1 Spend is a wholly-owned operating subsidiary of M1 Holdings Inc.

M1 Spend checking accounts furnished by Lincoln Savings Bank, Member FDIC. M1 Visa™ Debit Card is issued by Lincoln Savings Bank, Member FDIC.

—-

© Copyright 2020 M1 Holdings Inc.

All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

App distributed by: M1 Finance LLC; 200 N LaSalle St., Ste. 800; Chicago, IL 60601; United States